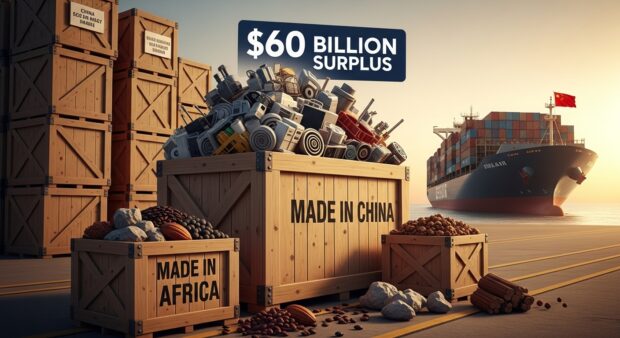

You’re witnessing a massive shift in global trade patterns. China has built up a staggering $60 billion trade surplus with Africa so far in 2025, nearly matching last year’s entire total. This surge comes as Chinese companies pivot away from U.S. markets due to President Trump’s tariffs.

The Numbers That Matter to You

Through August, you’ve seen China export $141 billion worth of goods and services to Africa while importing only $81 billion back. This widening gap reflects surging exports of Chinese-made batteries, solar panels, electric vehicles, and industrial equipment flowing into African markets.

The contrast is stark: while China’s exports to the United States plunged 33 percent in August, its exports to Africa grew 26 percent. You’re seeing Chinese manufacturers demonstrate remarkable resilience in finding new markets for their massive production output.

What You’ll Find on African Streets

If you walk through Kampala, Uganda’s bustling electronics districts, you’ll notice something remarkable. Nearly every storefront is packed with solar panels, and 99 percent of them bear the “Made in China” label. Chinese products have systematically displaced European and Indian competitors over the past decade, winning purely on price.

You’ll discover that it’s not just solar panels. Walk into any electronics shop and you’ll find that nearly everything—from lightbulbs to generators—comes from Chinese factories.

The Infrastructure Reality You Should Understand

For over a decade, you’ve watched China pour massive investments into African infrastructure through its Belt and Road Initiative. These projects have created a web of Chinese influence across the continent, opening business opportunities and securing access to valuable raw materials.

Meanwhile, you’ve seen the Trump administration slash foreign aid to Africa and impose tariffs on many African countries, including a 30 percent duty on South African goods. Some countries faced even steeper penalties—textile-dependent Lesotho was initially threatened with a 50 percent tariff, forcing it to declare a national disaster.

The Solar Energy Boom You’re Witnessing

You’re seeing a perfect storm in the solar sector. Chinese solar companies, struggling with cutthroat competition and overproduction at home, have found their salvation in Africa’s desperate need for energy. The result? Solar panel imports from China rose 60 percent in the last 12 months, with 20 African countries importing record amounts.

In Uganda alone, you’ll find more than eight Chinese companies operating distribution centers, competing so aggressively that solar panel prices have dropped 40 percent in just 12 months. European competitors have largely abandoned the field, leaving Chinese firms to dominate unopposed.

The Industrial Surge You Need to Know About

The numbers across all sectors will astound you. Steel shipments to Africa rose nearly 30 percent in just five months, while agriculture, construction, and shipbuilding machinery exports all jumped over 40 percent. Electric motors and generator exports surged more than 50 percent, and Chinese automobile exports to Africa rose 67 percent, with May shipments doubling.

You’re also witnessing China’s dominance in consumer markets. Four of Africa’s five biggest smartphone brands are Chinese, with Huawei and Xiaomi capturing the largest market share gains this year.

The Dilemma You Should Recognize

You’re observing African leaders caught in an impossible position. They understand they’re in a lopsided relationship—China consumes their natural resources while flooding their markets with manufactured goods, potentially undermining their own industrial development efforts.

Yet they feel compelled to maintain China’s favor because, as one economist puts it, “China is really the only game in town.” You’re watching African policymakers navigate this delicate balance between economic necessity and long-term sovereignty concerns.

What This Means for You

Whether you’re an investor, policymaker, or simply someone trying to understand shifting global dynamics, you’re witnessing a fundamental realignment. China’s pivot to Africa isn’t just about finding new markets—it’s about establishing long-term economic partnerships that could reshape both continents’ futures.

You’re seeing the early stages of what could become the most significant South-South trade relationship of the 21st century, with implications that extend far beyond simple import-export statistics.

Be the first to leave a comment