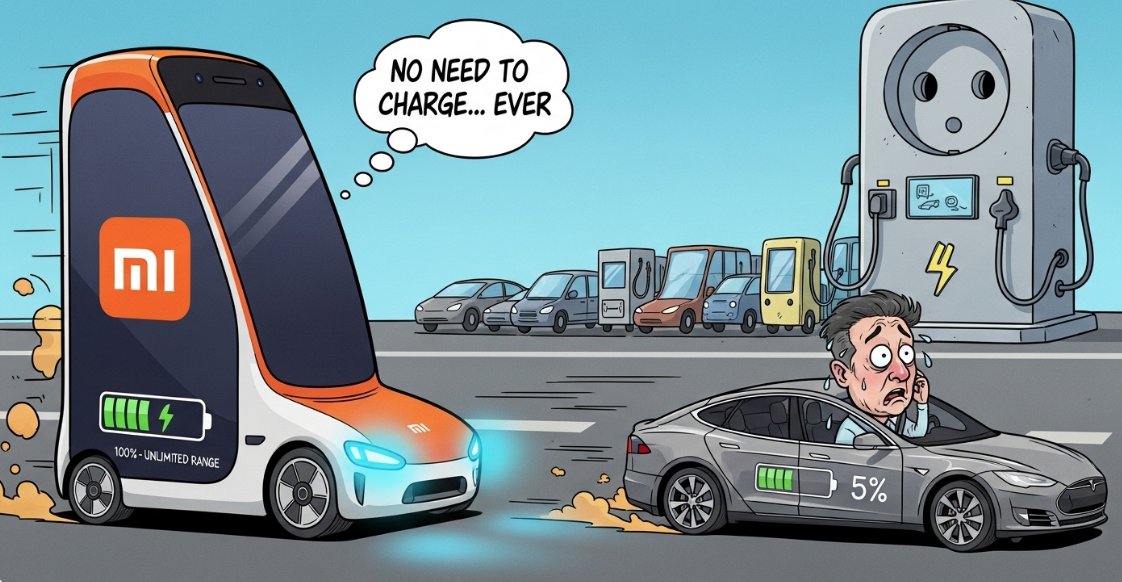

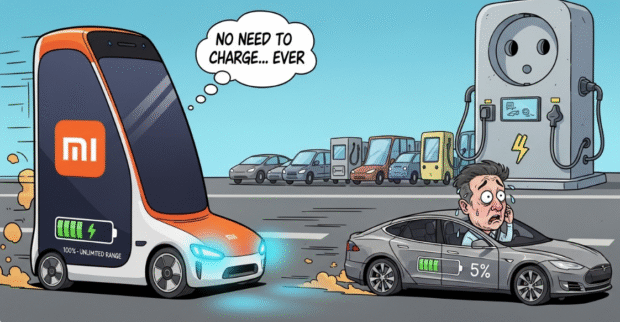

Looking for the next big thing in electric vehicles? Meet Xiaomi – the smartphone giant that’s about to give Tesla a serious case of range anxiety.

Why Xiaomi’s $5.5 Billion War Chest Changes Everything

While Tesla’s been busy with… let’s call them “extracurricular activities,” Xiaomi just secured a massive $5.5 billion funding round that signals a seismic shift in the EV landscape. This isn’t just another Chinese startup burning through venture capital – this is a tech powerhouse with the resources and ambition to rewrite the rules of electric mobility.

The Beijing-based company raised these funds through an upsized stock sale, moving 800 million shares at HK$53 each. Originally planning a smaller offering, investor demand pushed them to expand – a clear signal that the market believes in Xiaomi’s electric dreams. Every dollar of this windfall is earmarked for research and technology development, building the foundation for what could become Tesla’s most formidable challenger yet.

From Smartphones to Smart Cars: The Xiaomi Advantage

Here’s what makes Xiaomi different from the parade of EV wannabes: they already know how to scale consumer technology. The company that revolutionized smartphones by delivering premium features at accessible prices is applying the same playbook to electric vehicles. Their SU7 sedan launches at around $30,000 – positioning it squarely against Tesla’s Model 3, but with the backing of a company that understands mass market appeal.

Xiaomi isn’t playing small ball either. They’ve committed $10 billion over the next decade to automotive development, with CEO Lu Weibing targeting overseas expansion by 2027. The numbers back up the ambition: fourth-quarter revenue jumped nearly 50%, while EV sales targets increased from 300,000 to 350,000 units. The EV division alone generated $4.4 billion in revenue from over 136,000 SU7 deliveries.

The Chinese Electric Revolution is Real

Xiaomi isn’t alone in this surge. Fellow Chinese automaker BYD recently raised $5.6 billion in Hong Kong’s largest share sale in years, then proceeded to beat Tesla to the $100 billion revenue milestone with $107 billion compared to Tesla’s $97.7 billion. While Tesla’s been distracted, Chinese brands have quietly captured 4.2% of European new car registrations, with Chinese-owned brands reaching 6.9% market share.

Meanwhile, Tesla’s European market share in February dropped to 9.6% – its lowest February showing in five years. As one analyst diplomatically put it, “Tesla is experiencing a period of immense change,” which is corporate speak for “they’re getting their lunch eaten while their CEO plays politics.”

The Value Proposition: Innovation Meets Accessibility

What Xiaomi offers the market is something Tesla seems to have forgotten: the sweet spot between cutting-edge technology and mass market pricing. While Tesla pushes premium positioning and controversial leadership, Xiaomi focuses on delivering advanced EV technology without the premium attitude. Their approach mirrors their smartphone success – sophisticated engineering wrapped in consumer-friendly packaging and pricing.

The timing couldn’t be better. As Tesla phases out the current Model Y ahead of a refresh and navigates leadership distractions, Xiaomi is ramping up production with laser focus and deep pockets. The question isn’t whether Chinese EVs will challenge Tesla’s dominance – it’s how quickly they’ll overtake it.

For investors, consumers, and the industry at large, Xiaomi represents more than just another EV company. They’re the embodiment of a new era where automotive innovation comes from unexpected places, backed by serious capital and executed with the precision of proven technology leaders. Tesla had its moment to lead the revolution. Now it’s time to see if they can survive the competition they helped create.

Be the first to leave a comment