You’re watching the most significant geopolitical realignment since the end of the Cold War. The U.S. Dollar Index has fallen 10.7% in the first half of 2025, marking its worst performance for this period in over 50 years. This isn’t just economic turbulence—it’s the visible cracking of American financial hegemony and the birth of a multipolar world order that will reshape global power for generations.

Think of the dollar not just as currency, but as America’s most powerful geopolitical weapon. For seven decades, dollar dominance has allowed Washington to project power, enforce sanctions, and shape global behavior through financial leverage. When that weapon weakens, it doesn’t just change economics—it fundamentally alters the balance of global power.

The dollar index has fallen 10.8 percent in the first half of 2025, driven by America’s own policy missteps and strategic overreach. President Trump’s erratic tariff policies and attacks on Federal Reserve independence have shattered confidence in American institutional stability. Meanwhile, mounting fiscal irresponsibility signals to the world that America may no longer be the reliable economic anchor it once was.

The Geopolitical Earthquake Beneath the Surface

This isn’t your typical currency decline. The gap between U.S. bond yields and those of major partners sits at its widest since 1994, yet foreign investors are fleeing dollar assets at the fastest pace in decades. A recent Bank of America survey shows global fund managers at their lowest USD allocation since 2005—a clear vote of no confidence in American economic leadership.

What makes this moment historically significant is that America’s rivals aren’t just benefiting from dollar weakness—they’re actively orchestrating it. China, Russia, and other powers have spent years building alternative systems specifically designed to challenge dollar dominance. Now those systems are gaining traction as America’s own policies accelerate the exodus.

The war in Ukraine became the catalyst that transformed theoretical alternatives into practical necessities. When the West froze Russia’s dollar reserves overnight, every nation watching realized that holding dollars wasn’t just an economic decision—it was a geopolitical vulnerability.

China’s Strategic Moment

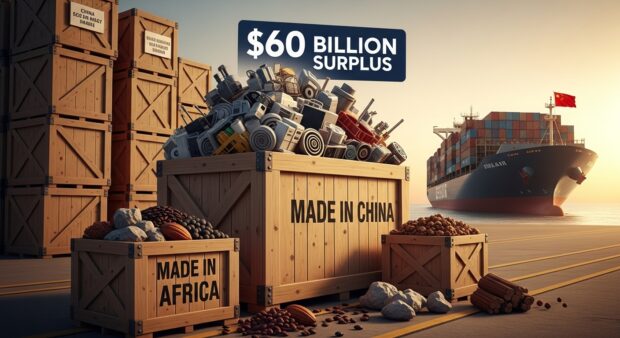

Beijing has been preparing for this moment for over a decade. China’s Belt and Road Initiative, once seen as primarily economic, now reveals its true strategic purpose: creating a global trade network that bypasses American financial control. As the dollar weakens, countries along these trade routes find it increasingly practical to settle transactions in yuan or local currencies.

China’s central bank digital currency initiative gains momentum as nations seek alternatives to SWIFT and other dollar-dominated payment systems. The digital yuan offers something no other currency can: a modern, efficient payment system completely independent of American oversight. Countries facing U.S. sanctions or fearing future sanctions see this as essential infrastructure for economic sovereignty.

The timing couldn’t be better for China’s geopolitical ambitions. As America turns inward with protectionist policies and challenges its own institutions, China presents itself as the stable, reliable partner for global trade. Dollar weakness makes this pitch increasingly credible to fence-sitting nations.

Russia’s Vindication Strategy

Moscow’s forced de-dollarization after 2014 sanctions, initially seen as economic punishment, now appears strategically prescient. Russia’s massive gold accumulation and development of alternative payment systems position it as a leader in the post-dollar world order it helped create.

The BRICS payment system, largely developed in response to Western sanctions, now attracts interest from countries that previously had no quarrel with America. Brazil, India, and South Africa find themselves at the center of a new financial architecture that offers alternatives to Western dominance.

Russia’s energy exports, increasingly priced in non-dollar currencies, demonstrate to other commodity exporters that alternatives exist. Each successful non-dollar energy transaction weakens America’s ability to project power through financial sanctions, creating a snowball effect of de-dollarization.

Europe’s Delicate Balancing Act

The European Union faces the most complex geopolitical calculations. While still allied with America, Europe recognizes that over-dependence on dollar systems creates vulnerabilities. The development of the digital euro and European payment systems reflects this strategic thinking.

Germany’s manufacturing sector benefits significantly from dollar weakness, but Berlin must balance economic opportunities against alliance commitments. The tension between European economic interests and transatlantic solidarity becomes more visible as dollar weakness accelerates.

France, with its historical skepticism of dollar dominance, sees vindication of its long-held position. President Macron’s calls for European strategic autonomy gain credibility as America’s financial reliability comes into question. The eurozone’s development of independent financial infrastructure reflects this growing confidence.

The Middle East’s Power Shift

Oil-producing nations find themselves at the center of the geopolitical transformation. Saudi Arabia’s gradual opening to non-dollar oil sales represents a seismic shift in global power dynamics. The petrodollar system, cornerstone of American financial dominance since the 1970s, faces its greatest challenge.

The United Arab Emirates positions itself as a bridge between Western and Eastern financial systems, developing infrastructure to handle both traditional dollar transactions and emerging alternatives. This hedge-betting strategy reflects the region’s recognition that the global financial order is in flux.

Iran’s forced development of non-dollar trade mechanisms due to sanctions now provides a template for other nations seeking to reduce dollar dependence. What began as sanctions evasion has evolved into a blueprint for financial independence from American oversight.

The Emerging Market Awakening

Countries across Africa, Latin America, and Asia recognize that dollar weakness creates opportunities for greater economic sovereignty. Nigeria’s development of digital currency initiatives, Brazil’s expansion of local currency trade agreements, and India’s rupee-based international trade all reflect this awakening.

These nations realize that America’s financial dominance often served American interests at their expense. Currency manipulation accusations, sanctions threats, and conditions attached to dollar-denominated aid created resentments that now find expression in alternative systems.

The African Union’s push for continental financial integration gains momentum as dollar weakness makes regional alternatives more attractive. What once seemed like distant aspirations now appear as practical necessities for economic development free from external interference.

America’s Strategic Responses

Washington faces stark choices as its financial hegemony erodes. Attempts to weaponize the remaining dollar dominance through expanded sanctions may accelerate the exodus to alternative systems. Yet accommodation to the new reality requires admitting that American unipolar dominance is ending.

The Federal Reserve’s policy choices carry unprecedented geopolitical weight. Rate cuts to support the domestic economy further weaken the dollar internationally, while rate increases to defend the currency could trigger domestic recession. Neither choice restores America’s previous financial dominance.

America’s political polarization compounds these challenges. International partners question whether the U.S. can maintain consistent policies across changing administrations. Dollar weakness reflects not just economic factors but growing doubts about American political stability and institutional reliability.

The New Alliance Structures

Traditional alliance structures strain under the pressure of changing financial realities. NATO allies find their economic interests increasingly diverging from their security alignments. Trade flows gravitate toward efficiency and mutual benefit rather than political loyalty.

New partnership arrangements emerge based on economic complementarity rather than ideological alignment. Countries develop multiple relationships across different spheres—security partnerships with one group, trade relationships with another, financial arrangements with a third.

The Non-Aligned Movement experiences a renaissance as countries seek to avoid choosing sides in the emerging great power competition. Dollar weakness makes this neutrality more economically viable than during the Cold War when American financial dominance made neutrality costly.

Your Strategic Positioning

Understanding these geopolitical shifts isn’t just academic—it’s essential for navigating the investment and business landscape of the next decade. Countries and regions aligning with emerging power centers may see accelerated growth as new trade and financial relationships develop.

Diversification across different geopolitical spheres becomes crucial as the world fragments into competing systems. Exposure to Chinese growth, European stability, and emerging market dynamism provides hedges against American decline while maintaining benefits from American innovation.

The development of alternative payment systems, trade corridors, and financial institutions creates investment opportunities in the infrastructure of the new world order. Companies and countries positioned to bridge different systems may capture outsized benefits from the transition.

The Bigger Picture: Empire’s End

This isn’t just about currency fluctuations or economic cycles. You’re witnessing the end of the American century and the emergence of a truly multipolar world order. The dollar’s role as global reserve currency was the foundation of American hegemony—more important than military might or technological leadership.

As that foundation crumbles, the entire structure of global power shifts. Countries gain sovereignty they haven’t enjoyed in decades. Regional powers assert influence in their spheres. The world becomes more complex but potentially more balanced.

The transition won’t be smooth or peaceful. Declining powers rarely accept their fate gracefully, and America retains formidable capabilities for disruption. But the direction is clear: the unipolar moment is ending, and the multipolar future is already emerging.

The question isn’t whether this transformation will continue—it’s whether you’ll position yourself to benefit from the new world order rather than cling to the fading American-dominated system. Geopolitical realignments create winners and losers. Understanding the forces at play determines which side of that divide you’ll occupy.

The dollar’s dominance is ending, and with it, America’s ability to shape global affairs through financial leverage. The new world order emerging from this transition will be more complex, more competitive, and more opportunity-rich for those who understand the changing power dynamics. The future belongs to those who adapt to multipolarity rather than mourn unipolarity.

Be the first to leave a comment